Action needed on the shady lenders who can take your car

Citizens Advice unveils the murky world of logbook loans

Aggressive behaviour, sexual harassment and death threats are just some of the brutish tactics logbook lenders used to intimidate customers, reveals new evidence from Citizens Advice.

The charity exposes the murky world of logbook loans as it finds borrowers face high interest rates, ridiculous charging structures and bamboozling language. Citizens Advice analysed 261 client cases about logbook loans which were reported between February 2011 and January 2014. New voluntary practices for the industry were introduced in 2011 but Citizens Advice evidence suggests this code of conduct is being flouted.

One in five people had had their car repossessed despite not being the original borrower. As it stands, cars sold with a logbook loan against them can be repossessed by the lender even though the new owner did not take out the loan. The car had been sold with the loan still attached to it and the new owner was completely unaware as the loans don’t have to be registered.

Citizens Advice wants this practice to be reversed and is calling on the Financial Conduct Authority and Government to require lenders to get a court order before they can take away someone’s car and to stop repossessions of cars that have been sold on with loans.

Logbook loans, or ‘bills of sale’ as they are known officially, are often taken out by people who find it difficult to get credit elsewhere as they’re able to secure the loan against their car. If the borrower struggles to keep up with repayments the car is taken away without any official process.

The analysis found the average loan was £1,286 but some people had borrowed as much as £19,000 and people have paid up to eight times the original loan by the time they got help from Citizens Advice.

Citizens Advice Chief Executive Gillian Guy said:

“The logbook industry is still in the dark ages and has been getting away with lawless practices. It is absolutely absurd that a firm should be able to take away someone’s possessions without any due legal process.

“High interest rates and lack of affordability checks as well as threatening practices and phantom charges mean logbook loans are a toxic mix of the worst parts of payday loans and unruly bailiffs.

“A 34 year old mother from the South East came to us for help after her car was repossessed by a bill of sale lender on her way to work at Gatwick airport. A tow truck driver had blocked her car, reached through the car window to take the keys and took the car without allowing her to remove her possessions. She was left on the roadside in the rain. When she paid to get the car back she found it had been damaged and drained of petrol.”

“It is really important that while payday lending is quite rightly tackled, other harmful forms of credit aren’t allowed to expand on the side-line. Our evidence shows that logbook lenders have paid little regard to the voluntary code and highlights the need for a tough stance from the Financial Conduct Authority.”

The Citizens Advice analysis of logbook loan cases reported by our clients found:

- 14% experienced harsh debt collection practices

- 28% were not treated fairly or appropriately by the lender

- 8% were hit with high charges for defaulting on their loan

- 17% had not had the terms of the loans clearly explained in a way they understood

- 9% had a lack of proper checks to make sure the borrower could repay

- 17% had their car taken away despite not being the original borrower.

Citizens Advice found the sky-high interest rates of logbook loans were compounded by extra charges. One woman in London fell behind on payments for her logbook loan and was £282 in debt. The lender had sent her eight letters and called her four times and for each of these the lender had added a £12 charge. She was also charged £6 for an ‘E-consumer trace’ and £6 for a ‘security alert request’ although both of these charges were not explained. In total she was charged £156, adding substantially to what she already owed. The code of practice states that no charges should be imposed on customers who are in arrears unless these charges had been disclosed before contact was made.

People have even had charges for paying on time and for repossession costs when the car has not actually been repossessed. Some of the charges and costs are listed below:

| Type of charge | Cost of charges |

|---|---|

| Charged for making an on time payment | £12 |

| Releasing van after it had been repossessed | £800 |

| Releasing car after it had been repossessed | £1000 |

| Repossession costs even though the car was not repossessed | £300 twice (£600) |

| Car repossessed storage charge | £2.00 per day plus VAT plus £20 admin charge |

| Late payment charge | £12 |

| Agent fees for early settlement | £480 |

| Letter from the lender | £12 |

| Phone call from the lender | £12 |

| Charge for monthly payments | £12 per week |

| Late payment | £54 |

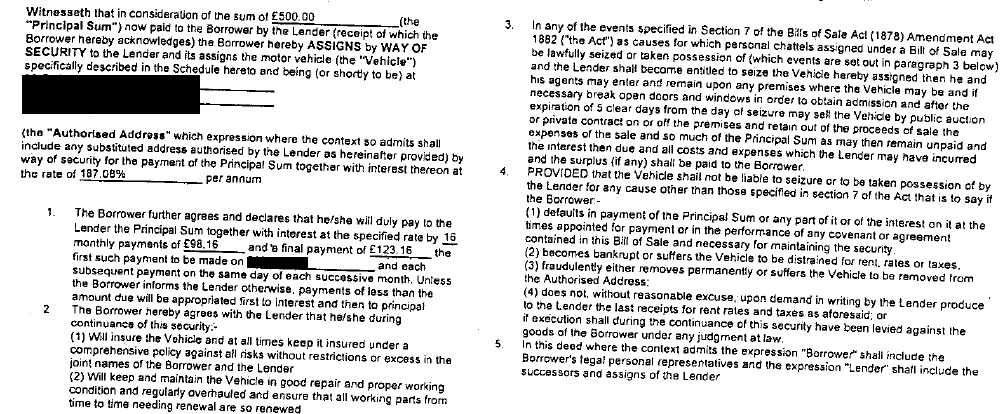

Many of the laws around bills of sale are unchanged since the Victorian era and the language used in the bills is often needlessly old-fashioned and confusing. The code of practice states that credit documents should be in “plain and intelligible language” yet some borrowers have been left unsure of the terms of their loan and its repayment schedule. One woman who took out a loan for £1000 with a logbook loan company believed that the terms of the loan meant it could be paid off in three months but when she thought she had paid it off she was told that she was tied into it for two years.

An example of a bill of sale with difficult language:

Case studies

- One Citizens Advice Bureau in Wales helped a single mother of three children whose property had recently been repossessed. She had a logbook loan for just under £1000 and the total amount to repay was nearly £3000 with an interest rate of 503.60% per annum. She was unable to maintain the payments for the loan.

- A 22 year old man from the South East bought a car on the internet for £1300 and spent an additional £600-£700 on improvements to it. He was given a logbook with the car but there was no indication that the car was subject to a bill of sale loan. He found that his car seemed to have been stolen one night but when he contacted the police he was informed that the car had been legally repossessed by a logbook loan company. The original owner had bought the car legally but taken a logbook loan out on it and then sold it on. The client lost his car and £2000. He faced having to recover his losses through a court process but had no guarantee of success and was unclear which of the former owners he should take to court.

Notes to editors:

- The Citizens Advice service comprises a network of local bureaux, all of which are independent charities, the Citizens Advice consumer service and national charity Citizens Advice. Together we help people resolve their money, legal and other problems by providing information and advice and by influencing policymakers. For more see the Citizens Advice website.

- The advice provided by the Citizens Advice service is free, independent, confidential, and impartial, and available to everyone regardless of race, gender, disability, sexual orientation, religion, age or nationality.

- To find your local bureau in England and Wales, visit citizensadvice.org.uk. You can also get advice online at adviceguide.org.uk

- You can get consumer advice from the Citizens Advice consumer service on 03454 04 05 06 or 03454 04 05 05 for Welsh language speakers

- Citizens Advice Bureaux in England and Wales advised 2.3 million clients on 5.4 million problems from October 2013 to September 2014. For full 2013/2014 service statistics see our quarterly publication Advice trends

- Citizens Advice service staff are supported by more than 21,000 trained volunteers, working at over 3,000 service outlets across England and Wales.