Harsh collection methods adding half a billion in fees to people’s council tax debt, Citizens Advice reveals

Outdated and punitive council tax regulations are encouraging local authorities to collect arrears aggressively - and it’s causing people serious financial harm, says Citizens Advice.

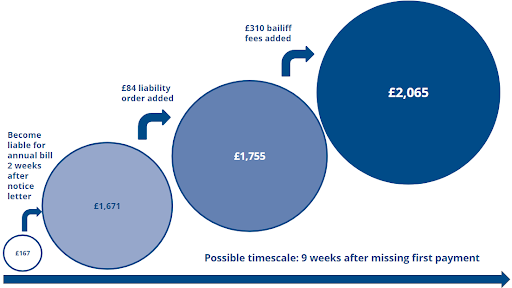

Its new research shows missing an average council tax payment of £167, in the first month of the financial year, can escalate to a debt of over £2,065 in just 9 weeks.

That’s because when someone falls behind on their council tax bill, they become liable for the rest of their annual bill after only 2 weeks. Two types of fees are then added on top of the original tax debt: court costs (typically £84) and bailiff fees (commonly £310).

Citizens Advice estimates over £560 million in fees were added to people’s council tax debt in 2016/17 alone. This includes £300 million of bailiff fees which is particularly concerning as some of these fees have to be paid by the person in debt before any council tax arrears can be recovered by the local authority.

While financial pressures on councils mean they are increasingly reliant on council tax to fund local public services, stretched household finances mean more people are struggling to keep on top of their essential bills, including council tax.

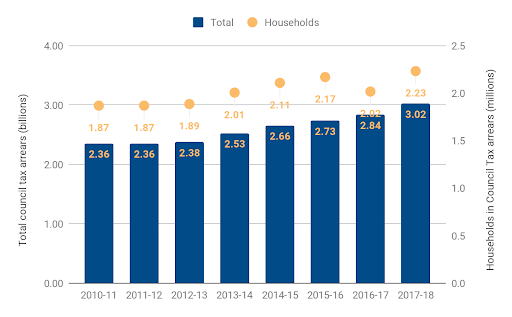

MHCLG data shows in 2018, there was over £3 billion of outstanding council tax debt (excluding fees). As shown by the chart below, an estimated 2.2 million households were behind with their council tax in 2017/18 out of 24.2 million that are liable to pay council tax. This is nearly 10% of all households.

Further analysis from the charity shows between 2010 and 2018, the amount of council tax debt grew by 30%. Council tax arrears have risen more than 6% in the last year alone.

The impact of aggressive debt collection was highlighted by MPs on the Treasury Select Committee last year, labelling government and local authorities “worst in class” for debt collection. They called for the public sector to raise its standards to the level of industry best practice - consumer creditors do not use many of the tactics used by local authorities.

In September, the National Audit Office said there was evidence that aggressive enforcement action is ineffective, and can be harmful in situations when someone is struggling to pay their debt.

The government announced this month that it will review the way local authorities collect council tax. Through this, Citizens Advice wants changes made to the legislation governing this that:

- Stops people being asked to pay their entire annual bill if they miss 1 monthly payment

- Adds statutory guidance stating that councils must attempt to develop an affordable repayment plan for the arrears before taking the debt through the courts

- Lets councils collect debts without having to use processes - such as a court order - which incurs fees for the person in debt

- Removes the threat of imprisonment for council tax arrears in England.

Citizens Advice wants to see these changes made alongside the creation of an independent bailiff regulator. The Ministry of Justice is consulting on this and will report back by the summer recess.

Mark D, 53, who is unemployed and has a mental health condition, said:

“Last year was not a good year in terms of my health or finances. I had so many debts that it became very stressful and hard to find a way to make my money stretch to cover them all.

“In August, a letter arrived from a bailiff. I had become liable for the full year bill and my council tax debt was now with them.

“I emailed the bailiffs about what documents they needed to class me as vulnerable because of my health. These were ignored but the threatening phone calls continued.

“I was told if I did not set up a payment plan on the phone they would send someone around to my house to collect my things. I felt really intimidated, agreeing to pay £10 a month, even though I knew I could not afford it.

“It was a big blow receiving the letters and calls. I was going through a really bad time and seeing the rising debt exacerbated the issues to a point where I felt worse within myself as I had no way of repaying the amount owed.

“In October I applied for a debt relief order but even while that was being processed, the bailiffs continued to demand immediate payments and threatened to send people around.

“When the order went through I was so relieved - those three months were frankly the most stressful and upsetting I’ve ever had.”

Gillian Guy, Chief Executive of Citizens Advice, said:

“By forcing local authorities to use rigid and outdated collection processes, council tax regulations make it harder for people to pay their original debts instead of helping them to get their finances back on track.

“Through its council tax collection review, the government must fundamentally reform the regulations governing how local authorities collect debts.

“Punitive processes such as charging a full year’s bill after a single monthly payment is missed show how broken the system is - they both tie the hands of councils and force people into debt.”

Background

Council tax arrears is the most common debt problem Citizens Advice helps people with.

Last year, its local services around England and Wales helped more than 96,000 people struggling to make their council tax payments.

On average Citizens Advice clients in council tax debt have just £14 a month disposable income.

Notes to editors

-

The ‘Costs of Collection’ report is available here.

-

The government has announced it will review the way council tax debt is collected. It should use its review to fundamentally reform the rules governing how local authorities collect debts by amending the Council Tax (Administration and Enforcement) Regulations 1992

-

A missed payment on an average Band D property of £167 can increase to a debt of £1671 within 2 weeks of receiving notice. Based on MHCLG, Council Tax levels set by local authorities in England 2018 to 2019 (revised) , April 2018

-

Council tax debt collection adds two types of fees to people’s debts - liability orders and bailiff fees. Liability orders typically add around £84 to people’s debts, while bailiff fees most commonly add £310 to people’s debts. This is an average of the combined costs of court summons and liability order fees of 49 local authorities in England and Wales according to their websites.

-

For an average council tax payer, missing a single payment of council tax in the first month of the financial year can result in a missed payment of £167 escalating to a debt of over £2,065. At its fastest, this process can take just 9 weeks. Typically, a notice is issued 2 weeks after a bill is due. After a further two weeks, people will become liable for their total annual bill. If this bill is not paid, after a further two weeks councils can issue a court summons and liability order. If the liability order is not paid within 14 days, the debt can be passed to a bailiff incurring a £75 enforcement fee. A further 7 days later, the debt can be escalated to ‘enforcement stage’. In total, a debt can escalate to enforcement stage within 9 weeks.

-

Council tax arrears figures are from Ministry of Housing, Communities and Local Government, Collection rates and receipts of council tax and non-domestic rates in England 2017-18 - revised , September 2018.

-

All Citizens Advice client data, unless specified otherwise in the report, is from April 2018 - March 2019.

-

The Treasury Committee’s comments on ‘worst in class’ debt collection can be found here.

-

The National Audit office’s comments on aggressive enforcement can be found here.

-

In November 2018, Citizens Advice published research on bailiffs breaking the rules and its call for independent bailiff regulation. In February 2019 as part of the Taking Control campaign on bailiff reform, it submitted a joint response to the Ministry of Justice’s Call for Evidence on bailiffs. The Minister has committed to reporting back on this by the summer recess.

-

Citizens Advice includes the national charity; the network of independent local Citizens Advice charities across England and Wales; the Citizens Advice consumer service; and the Witness Service.

-

Citizens Advice offers Pension Wise services at 500 locations in England and Wales.

-

Citizens Advice’s services are free, independent, confidential and impartial, and available to all regardless of race, gender, disability, sexual orientation, religion, age or nationality.

-

To get advice online or find your local Citizens Advice, visit citizensadvice.org.uk

-

For consumer advice, call the Citizens Advice consumer service on 03454 04 05 06 or 03454 04 05 05 to talk in Welsh.

-

We helped 2.6 million people face to face, by phone, email and webchat in 2017-18. For service statistics see our monthly publication Advice trends.

-

Citizens Advice staff are supported by over 23,000 trained volunteers, working at over 2,500 locations in England and Wales.