Cap on rent-to-own products could save consumers £276, says Citizens Advice

A total cost cap on rent-to-own items like washing machines, fridge freezers and televisions could save consumers £276 (28%) per product, new analysis from Citizens Advice has found.

The national charity has modelled the impact its proposed total cost cap in the rent-to-own sector would have. The FCA has indicated it will implement a cap by April 2019 and is currently looking at what form this will take.

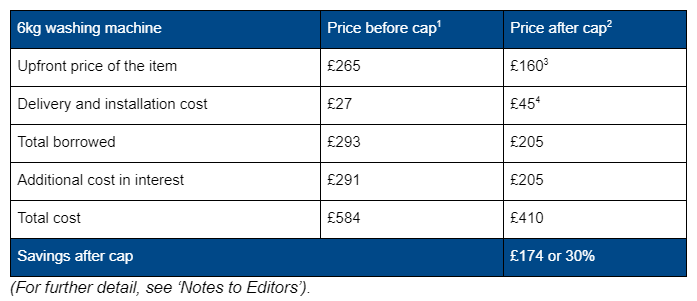

Citizens Advice found its suggested cap on the cost of a typical washing machine, purchased from a rent-to-own retailer, could save people £174 (30%). Consumers are typically tied in to such deals for 3 years.

The new analysis also compared the cost of 9 other household products available from the major rent-to-own providers, with the same items purchased upfront from a typical high street retailer.

Last year Citizens Advice helped more than 5,000 people with rent-to-own debts. Their average overall debt was £8,193.(For further detail, see ‘Notes to Editors’).

It says a cap on interest and charges associated with rent-to-own products could save consumers up to £62 million on 245,000 goods.

Citizens Advice is calling for the FCA to commit to its April 2019 deadline and implement its proposed 100% cost cap in the rent-to-own sector that:

- Makes rent-to-own products more affordable. By limiting the upfront cost of the item, plus installation/delivery fees and interest, the outstanding levels of debt held by rent-to-own clients would be reduced.

- Limits late payment charges at £15 per agreement per year. Nearly 60% of rent-to-own clients are charged late payment fees. These charges commonly amount to £72 over the course of a loan.

The charity says a cap will give people a clear idea of the total amount they are expected to repay, helping families to manage their money. It found 25% of people who had purchased a product didn't know the total amount they would have to repay.

Gillian Guy, Chief Executive of Citizens Advice, said:

"By 1 April 2019, it will have been 853 days since the FCA launched its high-cost credit review. Until a cap is introduced, consumers will continue to pay over the odds for these high-interest products.

"Caps can work, we've seen this with payday loans where thousands of consumers have been protected by the FCA and are now better off as a result.

"The FCA has recognised the massive harm caused by the high interest rates on tempting rent-to-own deals. It should now stick to its own deadline to implement a cap. No one should have to pay more than double what they borrow."

Citizens Advice will respond to the FCA's further consultation proposals - including on extended warranties, doorstep loans and overdrafts - ahead of the 31 August deadline.

Notes to editors

- These prices are based on averages between two major rent to own providers.

- This price is modelled on the structure of a cap that we have proposed in response to question 2 of the FCA’s call for evidence.

- This is based on the price of a similar product from Argos sold in June 2018.

- This is the standard cost of delivery and installation found at comparable home appliance stores.

- Figures in the charity's March 2018 'Rent to Return?' report show, if existing rent-to-own loans were priced down through a similar cap to that on payday loans, consumers could be protected from paying up to £62 million in repayments on 245,000 rent-to-own products.

- About 400,000 people have rent-to-own debt in the UK. In 2017, Citizens Advice helped more than 5,000 people with problems relating to these loans. Of these, the average amount of rent-to-own debt was £972, the average overall debt was significantly higher at £8,193, 63% had dependent children and, our clients were three times more likely to be female than male.

- Citizens Advice is made up of a network of local Citizens Advice in England and Wales, all of which are independent charities, the Citizens Advice consumer service and the national charity Citizens Advice.

- Together we help people resolve their money, legal and other problems by providing information and advice and by influencing policymakers.

- Citizens Advice is the statutory consumer advocate for energy and postal markets. We provide supplier performance information to consumers and policy analysis to decision makers.

- The Citizens Advice Witness Service provides free and independent support for both prosecution and defence witnesses in every criminal court in England and Wales.

- Citizens Advice also offers Pension Wise appointments at 500 locations across England and Wales.

- The advice provided by the Citizens Advice service is free, independent, confidential and impartial, and available to everyone regardless of race, gender, disability, sexual orientation, religion, age or nationality.

- To get advice online or find your local Citizens Advice in England and Wales, visit citizensadvice.org.uk

- You can get consumer advice from the Citizens Advice consumer service on 03454 04 05 06 or 03454 04 05 05 for Welsh language speakers.

- Last year we helped over 2.7 million people face to face, by phone, email or web chat. For full service statistics see our monthly publication Advice trends.

- Citizens Advice service staff are supported by more than 23,000 trained volunteers, working at over 2,500 service outlets across England and Wales.