Millions left in the cold and dark as someone on a prepayment meter cut off every 10 seconds, reveals Citizens Advice

New analysis from the charity reveals the stark reality for people who pay for their energy through a prepayment meter

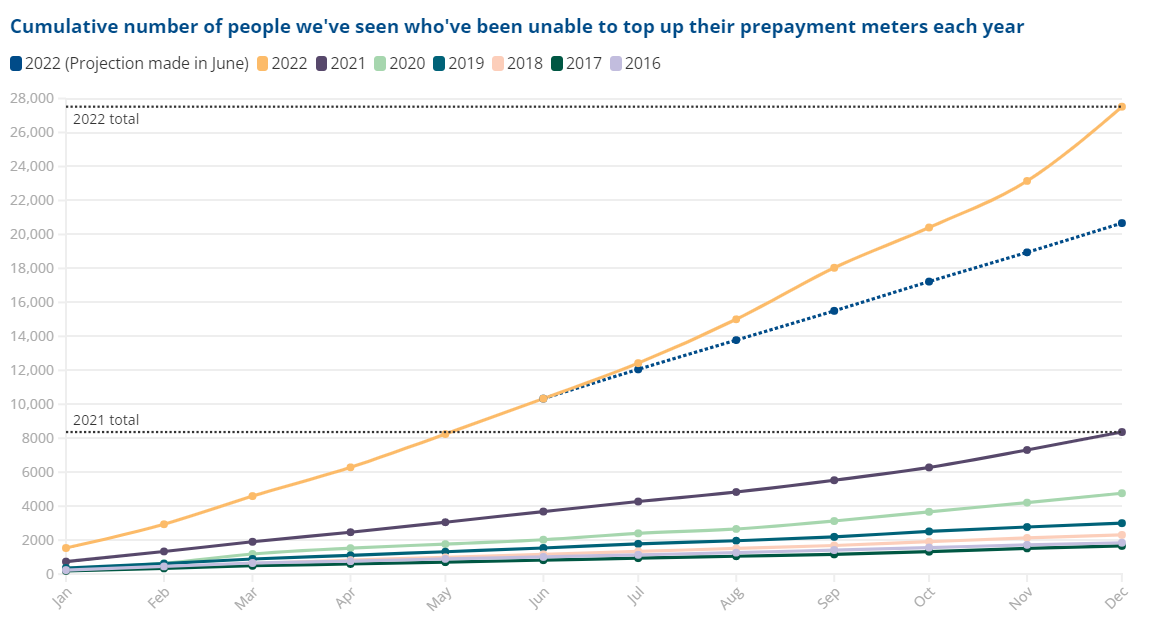

In 2022 Citizens Advice saw more people who can't top up their prepayment meter than in the whole of the last 10 years combined

The charity is now calling for a total ban on forced prepayment meter installations until new protections are brought in

New research from Citizens Advice found that 3.2 million people across Great Britain ran out of credit on their prepayment meter last year because they couldn’t afford to top up. That’s one person every 10 seconds - cut off from their energy supply as the cost-of-living crisis left people struggling to keep the lights on.

For most it’s not just a one off. Citizens Advice has found more than two million people are being disconnected at least once a month. And more than one in five (19%) prepayment meter customers cut off in the past year then spent at least 24 hours without gas or electricity, leaving them unable to turn the heating on or cook a hot meal.

Citizens Advice - the consumer watchdog for the energy market -is particularly concerned about disabled people and those living with long-term health conditions. Nearly one in five (18%) households including someone in this group, who ran out of credit last year, went on to spend two days or more without energy supply.

Over Christmas, my daughter and I sat in the cold and dark - Rona’s story

Rona is disabled and lives with her daughter who has special educational needs. She struggled to cope with rising energy bills and got into debt with her supplier. Without warning, her supplier switched her smart meter to prepayment mode, leaving her without gas and electricity.

Rona said:

“One evening just before Christmas my power went off. I assumed it was a power cut. I had no way to make any calls, so my daughter and I were left in the dark all night with no heating, lights or means of making any food. I was really anxious.

“I went to my local Citizens Advice when the power didn’t come back on the next morning. They spoke to my supplier and found out they’d switched my smart meter to prepayment mode.

“I explained that I was on the priority services register. I also said I’m in a wheelchair and unable to access my meter, but none of it made a difference. I’m now reliant on my sister or her husband to go to the post office to help me top up my meter.

“Over Christmas I went without energy because the credit ran out, and the post office was closed, so my daughter and I sat there cold, in the dark. How can I live like this?”

A worrying trend

In 2022 Citizens Advice saw more people who can't top up their prepayment meter than in the whole of the last 10 years combined. That grim record broke even the charity’s predictions for the amount of people it would help with the issue in the last year.

The energy regulator, Ofgem, has rules that means certain groups, such as disabled people and those with long-term health conditions, should not be forced onto a prepayment meter.

Citizens Advice previously raised concerns to Ofgem and the government that it had seen evidence of suppliers forcing people in these groups onto prepayment meters. In October, Ofgem warned suppliers that not enough was being done to identify customers in vulnerable circumstances before installing a prepayment meter.

Today, Citizens Advice reveals that in the month following Ofgem’s intervention more than a third of prepayment meter households including a disabled person, or someone with a long term health-condition, were cut off from their energy supply at least once. That’s more than 470,000 struggling households left in the dark.

Time for a change

Citizens Advice is now calling for a total ban on forced prepayment meter installations until new protections are introduced, ensuring households can no longer be fully cut off from gas and electricity.

The charity has seen a 229% increase in the past year in the number of people coming for help who can't afford to top up their prepayment meter.

It’s heard from people forced on to a prepayment meter, unable to top up even though their medication needs to be refrigerated. And there are stories like that of a single parent with a young baby, left in the cold and the dark for 48 hours after her supplier switched her to a meter she couldn’t keep topped up.

Based on Ofgem figures, Citizens Advice estimates that 600,000 people were forced onto a prepayment meter because they couldn't afford their energy bills in 2022. And it predicts 160,000 more people could be moved onto a prepayment meter by the end of winter if no further action is taken.

Dame Clare Moriarty, Chief Executive of Citizens Advice, said:

“All too often the people finding it hardest to pay their bills are being forced onto a prepayment meter they can’t afford to top up. This puts them at real risk of being left in cold, damp and dark homes.

“The staggering rise in the cost of living means many simply cannot afford to heat and power their homes to safe levels.

“New protections are needed to stop people being fully cut off from gas and electricity. Until then, there must be a total ban on energy companies forcing those already at breaking point onto prepayment meters. If Ofgem doesn't act, the government must intervene.”

Notes to editors

Further information can be found in ‘Kept in the Dark’, the new report from Citizens Advice which is available on request.

Survey data based on a representative poll of 4,384 adults (18+) in the UK conducted by Yonder Data Solutions for Citizens Advice, fieldwork conducted between 6th and 15th December 2022.

3.2 million people across Great Britain ran out of credit last year because they couldn’t afford to top up their meter. Figure takes the number of households unable to top up from our recent survey and grosses up to people using the average number of people in a household (2.4).

Citizens Advice spoke to 27,521 people in 2022 who couldn’t top up their prepayment meter, which is more than the whole of the previous ten years combined.

Based on Ofgem figures and average UK household size, Citizens Advice estimates that 600,000 people were forced onto a prepayment meter because they couldn't afford their energy bills in 2022, compared to 380,000 in 2021.

The estimate for 2022 (600,000 moved to a prepayment meter) is based on Ofgem data for Q1, Q2 and Q3 on the number of electricity meters changed to prepayment mode (traditional and smart) due to debt. We have used electricity meters as a proxy for the number of households and this is multiplied by the average UK household size to get our estimate for the number of people. Data for Q4 2022 is not available yet, so we have assumed that Q4 will be the same as Q3 2022 - the most recent available data from Ofgem. We have also assumed that Q1 of 2023 will be the same as Q3 2022.

Citizens Advice is made up of the national charity Citizens Advice; the network of independent local Citizens Advice charities across England and Wales; the Citizens Advice consumer service; and the Witness Service.

Our network of charities offers impartial advice online, over the phone, and in person, for free.

Citizens Advice helped 2.55 million people face to face, over the phone, by email and webchat in 2021-22. And we had 40.6 million visits to our website. For full service statistics see our monthly publication Advice trends.

Citizens Advice service staff are supported by more than 18,500 trained volunteers, working at over 2,500 service outlets across England and Wales.

Citizens Advice is the largest provider of free, multi-channel debt advice. Providing that help gives Citizens Advice unique insight into the types of debts people struggle with.

Citizens Advice is the statutory consumer advocate for energy and postal markets. We provide supplier performance information to consumers and policy analysis to decision makers.

You can get consumer advice from the Citizens Advice consumer service on 0808 223 1133 or 0808 223 1144 for Welsh language speakers.