New restrictions, missing protections

Millions of people are now living in areas with the highest level of coronavirus lockdown. New analysis by Citizens Advice reveals a series of gaps in protections which mean people unable to pay essential bills could fall into debt or face harsh enforcement.

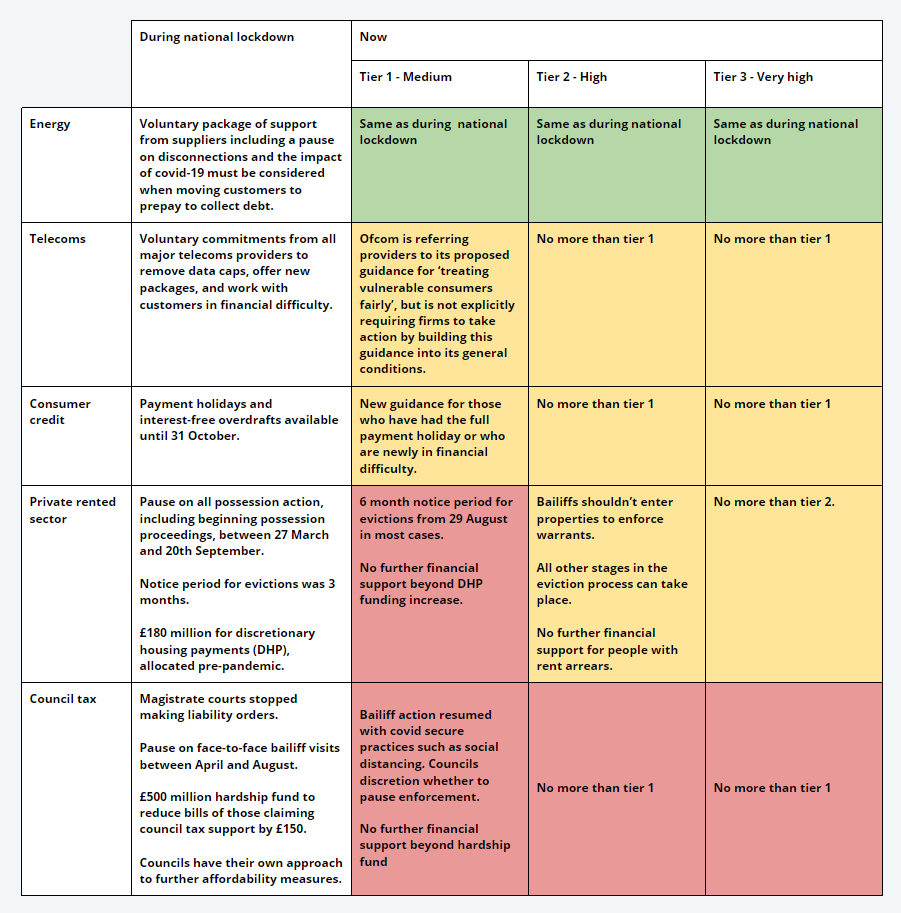

The analysis shows that the existing protections in England do not align with the coronavirus lockdown tiers and that in some areas, particularly rent and council tax, the lack of broad national protections could see people at risk of falling behind on vital bills.

Colour coding system: Green - same or greater protections than national lockdown, Amber - some protections but fewer than during national lockdown, Red - no new protections.

Citizens Advice estimates around 6 million people fell behind on bills during the initial coronavirus lockdown, with carers, shielders, key workers and BAME people most seriously affected. The charity says the government must act now to ensure people aren’t pushed into further debt as restrictions tighten once again.

Jamie McGlynn, Local Service Manager at Citizens Advice Manchester, says:

“Now that many of the protections have been lifted, we’re seeing a surge in people contacting us for help as bailiffs, debt letters and eviction notices start up again.

“Added to that, there have been a lot of redundancies announced in recent weeks and many people we help are working reduced hours because of the impact of the first lockdown.

“If we move into the “Very High” tier without further protections in place, I’m worried about a perfect storm where people already struggling to keep their head above water financially are going to really suffer.”

“We’re also seeing lots of people whose income has dropped to nothing as they self-isolate. They’re hugely worried about the possibility of missing vital bills or running up rent arrears.”

Dame Gillian Guy, Chief Executive of Citizens Advice, said:

“Many of the protections that the government and regulators rightly put in place for people struggling with bills have ended or are running out. But lifting these protections was founded on the prediction that household finances would improve as the UK left lockdown. For many in the highest tier of coronavirus restrictions, this will now simply not happen.

“Some regulators, like Ofgem, have been proactive in strengthening protections as we enter what is likely to be a hard winter for many. In other sectors, help for people living in the areas of strictest lockdown is confusing, inconsistent and, in some areas, inadequate.

“As more parts of the country move into the highest tier of coronavirus restrictions, a renewed package of protections and support is vital to keep people living there from falling into further debt.”

Citizens Advice is calling for:

On council tax:

A pause on the enforcement of council tax arrears in Tier 3 areas.

Additional, one-off funding for local councils to allow them greater freedom to support people behind on their council tax. This should be prioritised in areas entering a Tier 3 lockdown.

On private sector rents:

People in tier 2 and 3 areas who are facing eviction should be given at least one month's notice when local restrictions come to an end before they are made to leave their home.

A national programme of government-backed grants and loans for tenants struggling to pay their rent because of the pandemic. Tier 3 areas should be prioritised for new grants.

Background

Last week new research from Citizens Advice showed significant numbers of people risk being pushed into a position where they can’t pay their essential bills and could face spiraling debts if the uplift to Universal Credit and Working Tax Credit is not extended beyond April 2021.

The findings come from the report Life on Less than Zero.

In August, Citizens Advice found one in 9 people, the equivalent of 6 million people across the UK, have reported falling behind on household bills because of coronavirus.

Notes to editors

Protections for people falling behind on household bills differ in the devolved nations. The recommendations above apply to England. You can find more details of the support available in Wales , Scotland and Northern Ireland .

Citizens Advice is made up of the national charity Citizens Advice; the network of independent local Citizens Advice charities across England and Wales; the Citizens Advice consumer service; and the Witness Service.

Our network of charities offers impartial advice online and over the phone, for free.

We helped 2.8 million people face to face, over the phone, by email and webchat in 2019-20. And we had 34.5 million visits to our website. For full service statistics see our monthly publication Advice trends.

Citizens Advice is the largest provider of free, multi-channel debt advice. Providing that help gives Citizens Advice unique insight into the types of debts people struggle with.

You can get consumer advice from the Citizens Advice consumer service on 0808 223 1133 or 0808 223 1144 for Welsh language speakers.